Unlock The Power: A Guide To Leveraging Return Formulas

How can "leveraged return formula" enhance your financial strategy?

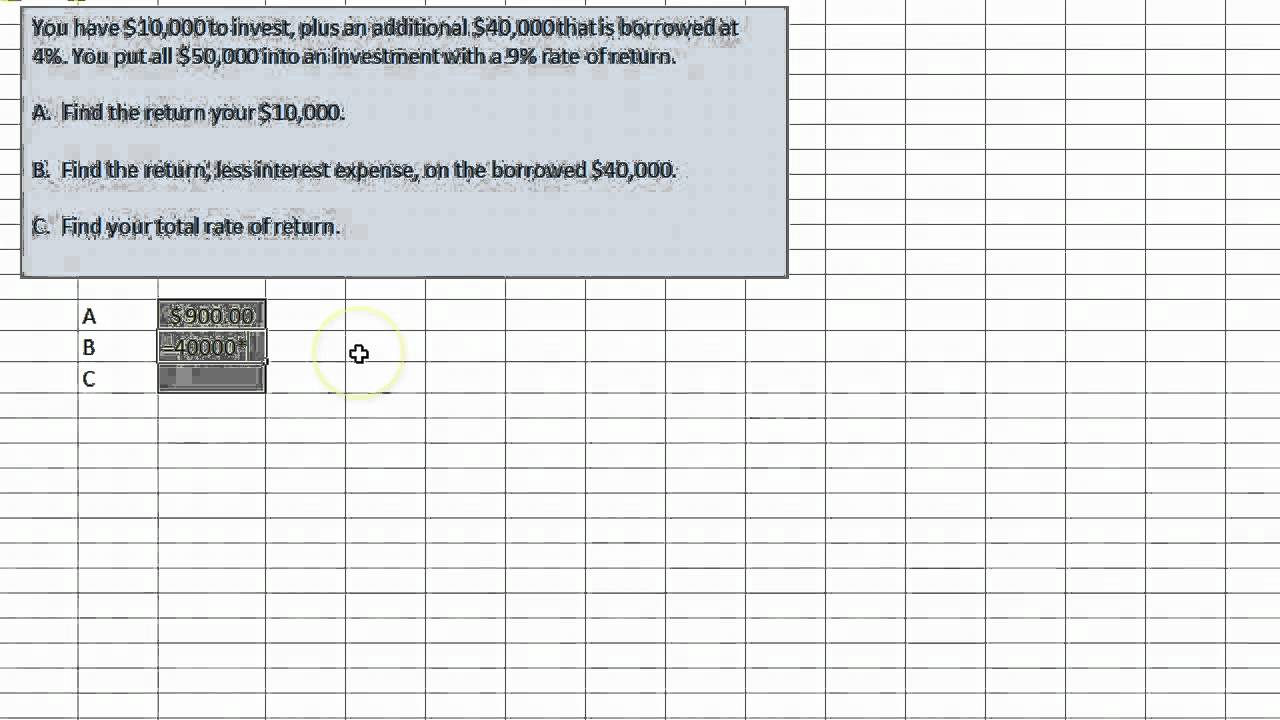

A leveraged return formula is a mathematical calculation used to determine the potential return on investment (ROI) when using leverage, such as a loan or borrowed capital. It considers the initial investment, the amount of leverage employed, and the expected rate of return.

Importance and Benefits:

- Magnified Returns: Leverage can amplify potential returns, allowing investors to earn more with a smaller initial investment.

- Increased Diversification: By incorporating leverage, investors can diversify their portfolio and reduce risk exposure.

- Enhanced Cash Flow: Leverage can free up cash flow, which can be reinvested for further growth or other financial goals.

Transition to Main Article Topics:

- Calculating Leveraged Return

- Risks and Considerations

- Applications in Real Estate and Stock Market

Leveraged Return Formula

The leveraged return formula is a crucial tool for investors utilizing leverage to enhance returns. Here are six key aspects to consider:

- Initial Investment

- Leverage Ratio

- Rate of Return

- Risk Tolerance

- Investment Horizon

- Tax Implications

Understanding these aspects is essential for effectively employing the leveraged return formula. For instance, a higher leverage ratio can magnify returns but also increase risk. Investors must carefully assess their risk tolerance and investment horizon before implementing leverage. Additionally, tax implications can impact the overall return, and investors should consult with a financial advisor to optimize their strategy.

1. Initial Investment

In the leveraged return formula, the initial investment represents the amount of capital an investor contributes before employing leverage. It serves as the foundation upon which the potential return is calculated. A larger initial investment generally leads to a higher potential return, assuming other factors remain constant.

The initial investment plays a crucial role in determining the overall risk and return profile of a leveraged investment. A higher initial investment reduces the leverage ratio, which in turn lowers the risk associated with the investment. Conversely, a smaller initial investment increases the leverage ratio, potentially amplifying both the return and the risk.

Understanding the relationship between initial investment and leveraged return is essential for investors seeking to optimize their financial strategy. By carefully considering the amount of capital they are willing to commit, investors can make informed decisions about the appropriate level of leverage to employ, balancing the potential for higher returns with the associated risks.

2. Leverage Ratio

In the leveraged return formula, the leverage ratio represents the proportion of borrowed capital used to finance an investment compared to the initial investment. It is a crucial factor that significantly influences the potential return and risk associated with the investment.

A higher leverage ratio amplifies both the potential return and the potential risk. This is because leverage magnifies the effects of both positive and negative market movements. In rising markets, a higher leverage ratio can lead to substantial gains, but in falling markets, it can result in significant losses.

Understanding the relationship between leverage ratio and leveraged return is essential for investors seeking to optimize their financial strategy. By carefully considering the appropriate leverage ratio for their risk tolerance and investment goals, investors can make informed decisions about how to allocate their capital and potentially enhance their returns.

3. Rate of Return

In the context of the leveraged return formula, the rate of return is a critical factor that determines the overall profitability of an investment. It represents the percentage gain or loss on an investment over a specific period of time.

- Expected Rate of Return: This refers to the anticipated rate of return on an investment based on market conditions, historical data, and financial projections. It is used in the leveraged return formula to calculate the potential return on investment.

- Actual Rate of Return: This is the realized rate of return on an investment after all expenses and fees have been accounted for. It may differ from the expected rate of return due to unforeseen market fluctuations or other factors.

- Leveraged Rate of Return: When leverage is employed, the rate of return is amplified. This means that the potential return on investment is higher, but so is the potential for loss.

- Risk-Adjusted Rate of Return: This metric considers both the rate of return and the level of risk associated with an investment. It helps investors compare different investment options and make informed decisions based on their risk tolerance.

Understanding the relationship between rate of return and leveraged return formula is crucial for investors seeking to maximize their returns while managing risk. By carefully considering the expected rate of return, actual rate of return, and risk-adjusted rate of return, investors can make informed decisions about the appropriate use of leverage.

4. Risk Tolerance

In the context of the leveraged return formula, risk tolerance is a critical factor that influences an investor's financial decisions and potential returns. It represents the level of risk that an individual is willing to accept in pursuit of higher rewards.

- Understanding Risk Tolerance: Risk tolerance is influenced by various factors, including financial situation, investment goals, and psychological makeup. Some investors may be more risk-averse, preferring to preserve capital, while others may be more risk-tolerant, seeking higher potential returns.

- Impact on Leveraged Investments: Risk tolerance plays a significant role in leveraged investments. Leverage magnifies both potential returns and risks. Investors with higher risk tolerance may be more inclined to use leverage to enhance their returns, while those with lower risk tolerance may prefer to limit their exposure to risk.

- Assessing Risk Tolerance: Before engaging in leveraged investments, it is crucial to carefully assess one's risk tolerance. This involves evaluating financial goals, time horizon, investment experience, and emotional resilience. Investors should only employ leverage to the extent that they are comfortable with the potential risks.

- Managing Risk: Once risk tolerance is determined, investors can implement strategies to manage risk in leveraged investments. This may include diversifying portfolios, setting stop-loss orders, and monitoring market conditions regularly.

In summary, risk tolerance is a fundamental consideration when utilizing the leveraged return formula. By understanding their risk tolerance and implementing appropriate risk management strategies, investors can optimize their financial outcomes and make informed decisions in the pursuit of higher returns.

5. Investment Horizon

In the context of the leveraged return formula, investment horizon refers to the length of time an investor plans to hold an investment before selling it. It is a critical factor that influences the potential return and risk associated with leveraged investments.

A longer investment horizon generally favors leveraged investments. This is because it allows investors to ride out market fluctuations and potentially capture higher returns over time. Leverage amplifies both gains and losses, so a longer investment horizon provides more opportunities for the investment to recover from any short-term setbacks and generate positive returns.

Conversely, a shorter investment horizon may increase the risks associated with leveraged investments. If the market experiences a downturn during the holding period, investors may not have sufficient time to recover their losses before they need to sell the investment. This can lead to significant financial losses, especially if the leverage ratio is high.

Understanding the relationship between investment horizon and leveraged return formula is crucial for investors seeking to optimize their financial outcomes. By carefully considering their investment horizon and risk tolerance, investors can make informed decisions about the appropriate use of leverage and potentially enhance their returns.

6. Tax Implications

Tax implications play a significant role in leveraged return formula as they directly impact the overall profitability of leveraged investments. Understanding the tax implications is crucial for investors seeking to optimize their financial outcomes and make informed decisions.

- Capital Gains Tax: When an investment is sold for a profit, the investor may be liable to pay capital gains tax on the profit. Leverage can amplify capital gains, potentially leading to higher tax liability.

- Interest Deductibility: Interest expenses incurred on borrowed funds used for leveraged investments are generally tax-deductible. This can reduce the overall cost of borrowing and enhance the potential return on investment.

- Margin Loan Interest: Interest paid on margin loans used for leveraged investments is typically not tax-deductible. This can increase the cost of borrowing and reduce the potential return on investment.

- Tax-Advantaged Accounts: Using leverage within tax-advantaged accounts, such as 401(k)s and IRAs, may provide additional tax benefits. This is because earnings and withdrawals from these accounts are often tax-deferred or tax-free.

In summary, tax implications can significantly impact the potential return on leveraged investments. Investors should carefully consider the tax consequences before employing leverage and consult with a qualified tax professional to optimize their financial strategy.

FAQs on Leveraged Return Formula

This section addresses commonly asked questions and clarifies misconceptions surrounding the leveraged return formula, providing a comprehensive understanding of its implications.

Question 1: What is the key benefit of using the leveraged return formula?

The leveraged return formula allows investors to amplify their potential returns by utilizing borrowed capital, offering the opportunity for higher gains compared to investing with only their own capital.

Question 2: How does the leverage ratio impact the potential return?

The leverage ratio, which represents the proportion of borrowed capital used, has a direct impact on the potential return. A higher leverage ratio amplifies both potential gains and losses, increasing both the upside and downside risk.

Question 3: What is the role of risk tolerance in leveraged investments?

Risk tolerance plays a critical role in leveraged investments. Investors should carefully assess their risk tolerance and ensure that it aligns with the potential risks associated with using leverage. Higher risk tolerance allows for the use of higher leverage ratios, while lower risk tolerance may warrant more conservative leverage strategies.

Question 4: Can leverage be used in tax-advantaged accounts?

Yes, leverage can be used within certain tax-advantaged accounts, such as 401(k)s and IRAs. However, it is important to consider the specific rules and tax implications associated with using leverage within these accounts.

Question 5: Is the leveraged return formula suitable for all investors?

The leveraged return formula may not be suitable for all investors. Investors should carefully evaluate their financial situation, investment goals, risk tolerance, and investment horizon before considering leveraged investments. It is advisable to consult with a qualified financial advisor to determine the appropriateness of leverage in a particular investment strategy.

Summary:

The leveraged return formula can be a powerful tool for investors seeking to enhance their potential returns. However, it is crucial to understand the risks and implications associated with leverage and to use it judiciously. Careful consideration of factors such as leverage ratio, risk tolerance, tax implications, and investment horizon is essential for making informed decisions and maximizing the benefits of leveraged investments.

Transition to the Next Section:

In the next section, we will delve deeper into the practical applications of the leveraged return formula in different investment strategies...

Conclusion

The leveraged return formula provides investors with a valuable tool to calculate potential returns when utilizing borrowed capital. Understanding the formula's components and implications is crucial for effective implementation. Key factors to consider include leverage ratio, risk tolerance, investment horizon, and tax implications.

Harnessing leverage effectively can magnify returns, enhance portfolio diversification, and free up cash flow. However, it is essential to proceed with caution and carefully assess the associated risks. Investors should ensure their risk tolerance aligns with the potential volatility of leveraged investments and consider seeking professional advice when necessary.

In conclusion, the leveraged return formula empowers investors to make informed decisions about incorporating leverage into their investment strategies. By balancing the potential for higher returns with the associated risks, investors can leverage this tool to optimize their financial outcomes.

Article Recommendations

- The Life And Family Of Niall Horan An Indepth Look At His Wife And Son

- Exploring The World Of Mkvmoviespoint Everything You Need To Know

- Kash Patel Wife